If we asked you how long it would take you to find the expiry date of a specific PPA, or confirm what structures were in place for another PPA, what would your answer be? Can you find this information instantly? Or does it sit in more than one system?

What about your asset data? You should be able to easily find the P50 MWh energy yield for a particular asset. More often than not, these are critical pieces of data that are not directly to hand and are getting lost or found too late. Does this matter? Yes.

Without appropriate master data management in place, a single contract may be dual entered across systems rather than working from the original document source. This duplication is prone to mismatches e.g. ‘Windfarm 1 baseload 2022’ could be replicated as ‘Windfarm 1 BL 2022’. You may be familiar with this same issue in CRM systems, where double entries are made for clients with small naming variations. For renewables, portfolio management it is not just a simple annoyance of having messy data. It could be a significant barrier when analysing your portfolio health. If contracts are not properly comparable and data such as termination deadlines, guarantees and so on are not exact, how can you be confident you have a true picture of your portfolio? How can you manage it in line with today’s market volatility?

It became apparent to us that weak master data management was more than just an inconvenience and actually a bigger concern impacting PnL. Our belief is that many organisations are vulnerable to financial losses by not having clear sight of contracts, deadlines and terms. To strengthen our opinion we heard of two separate issues renewables sellers had encountered in the past and that we are seeing happen more frequently today in our faster paced markets.

Issue #1: Missing your PPA expiry date

The first was an error we suspect more businesses may be vulnerable to; being unaware that a PPA has or is immediately about to, expire. Easily done when you have no visibility of PPA expiry dates across your portfolio. The impact? They lost their negotiating power.

A PPA negotiation period can be as quick as 1 month or typically longer, up to 1 year . During this time there are considerable communications back and forth relating to the commercial terms, as buyers and sellers tweak their agreement to achieve the right balance of future revenue and risk. Obviously as producers must sell energy, having shorter notice periods to generate new PPAs leaves zero negotiation power. You have less time for manoeuvre resulting in two unfavourable options.

One, having to agree on terms that are far from optimal or two, becoming exposed to the spot market. So while you will find your buyer, it is unlikely to be at the best price and could result in having to accept more risk than is within your risk tolerance.

Gaining visibility

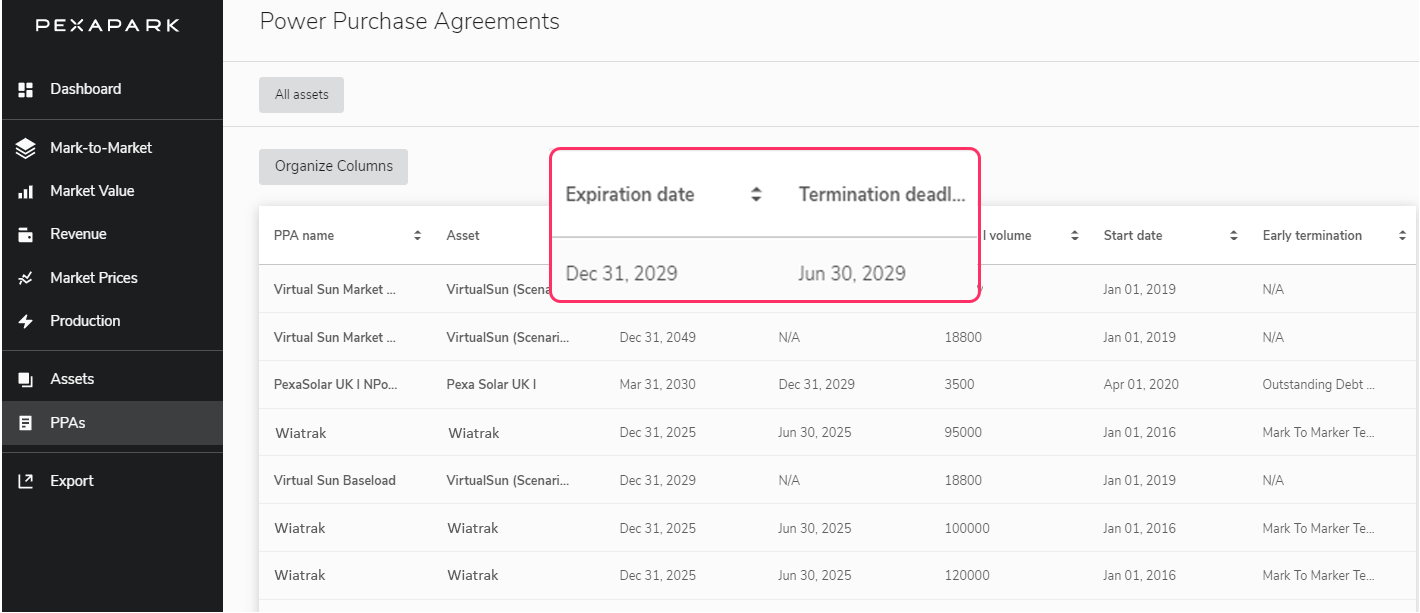

Using our revenue and risk management system, PexaMonitor, this can be avoided. You can view all expiry dates and termination deadlines at a glance.

We have added filtering to make searching for the data work like a well-managed spread sheet. By clicking on each contract you get immediate visibility of the contractual terms, guarantees and legal information, making it faster to report, compare PPAs and analyse your portfolio. You can jump directly to the key information without reading through wordy legal docs.

In addition to entering the critical data from PPA contracts, our users can also upload the original document onto our revenue and risk management solution. This means they can access the full details in a few clicks, if needed for future negotiations or queries.

Using a central repository creates a single source of truth removing data reconciliation issues and improving reporting accuracy.

Issue #2 Forgotten PPAs

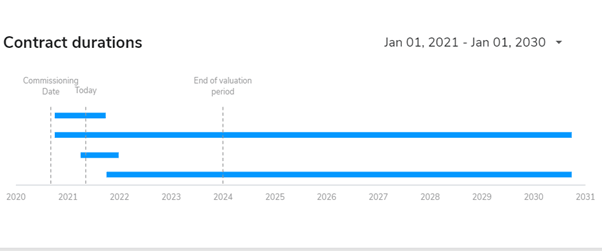

The second key error is selling energy twice. We learned of an occasion where a seller had not realised a PPA was already in place. They had hedged out years 1-5 and already had a PPA in place for years 5-10. As year 5 approached, the original PPA had become forgotten, its details buried in a general contract system along with other non PPA related contracts. Without realising this original PPA, they went on to secure a second, doubling their position, without the means to deliver.

We can help avoid this happening quite simply by basing all portfolio calculations from the centrally held master data. We provide a clear visual representation of your position overview.

The pitfalls of spread sheets and central data management

Spread sheets are the best alternative to a formal data repository and can give the visibility and filtering flexibility needed. However they fall short when it comes to permissions and auditability. You don’t have controls on who edits the PPA data. And should data be incorrectly entered, you don’t have an audit history to see who made changes.

We also see the concept of central master data management falling short of what it really needs to do. Rather than simply storing data, it is far more important to provide a good data exchange between systems that are grouped around use cases and user groups. This approach provides a single point of truth, but with the added value that it is more easily accessible where the user needs it to be. This is precisely our method, we offer to read-in and read-out the master data PPA data.

Gaining the right controls

Our tool enables the quick assessment of all PPAs across your portfolio. You can view and compare structures and track your position effortlessly. Users can efficiently see when PPAs are expiring and their termination deadlines, meaning there is always the time needed to prepare for the next transaction.

With our revenue and risk management solution, PexaMonitor, you also gain full auditability to identify which user made which changes. You have the controls to manage user permissions, determining who has editing rights.

As you move further into merchant markets, can you afford to lose sight of your critical PPA data?

If any of the issues raised in this article resonate with you, why not Contact Us . We can explore how your management of PPA contracts can be improved and discover the value it could bring to your organisation.