Everyone always wants to get the best price for their PPA – the higher the bid you get, the larger your chance of securing a third-party financing.

With that in mind, a common thought occurs to the sellers :

“Is there a best time during the year to close a PPA ? Is there a season where bids available are likely to be more advantageous?”

It’s a very good question and we all heard about the “seasonality in the electricity prices”, but does that mean that there is also some sort of intra-year seasonality in PPA prices indicating a repeating pattern of lower or higher prices?

To answer this question, it’s important first to understand what the main driver behind a transactable PPA price is. Firstly, utilities and trading houses manage PPAs and their resulting exposure directly on the market. (Usually when a PPA is closed, it is immediately hedged using tradeable products in a process called “stack-and-roll hedging”).

This is the reason why an offtaker pricing a contract is relying on the market-based curves. PPA fluctuations can usually be attributed to the fluctuations at the market level.

Seasonality would therefore also have to come from regular and predictable changes that recur every calendar year in market power product prices. But is there really any sign of that?

Intuitively, the answer should be NO: if the market is efficient, there can be no seasonal effects in the prices, otherwise it would lead to arbitrage. Let’s imagine it: if prices would be expected to be higher in some point of the year – most of the players wanting to enter a short position would wait to do so until then, putting downward pressure on prices thus eradicating this effect.

To illustrate it better, let’s look at some historical data.

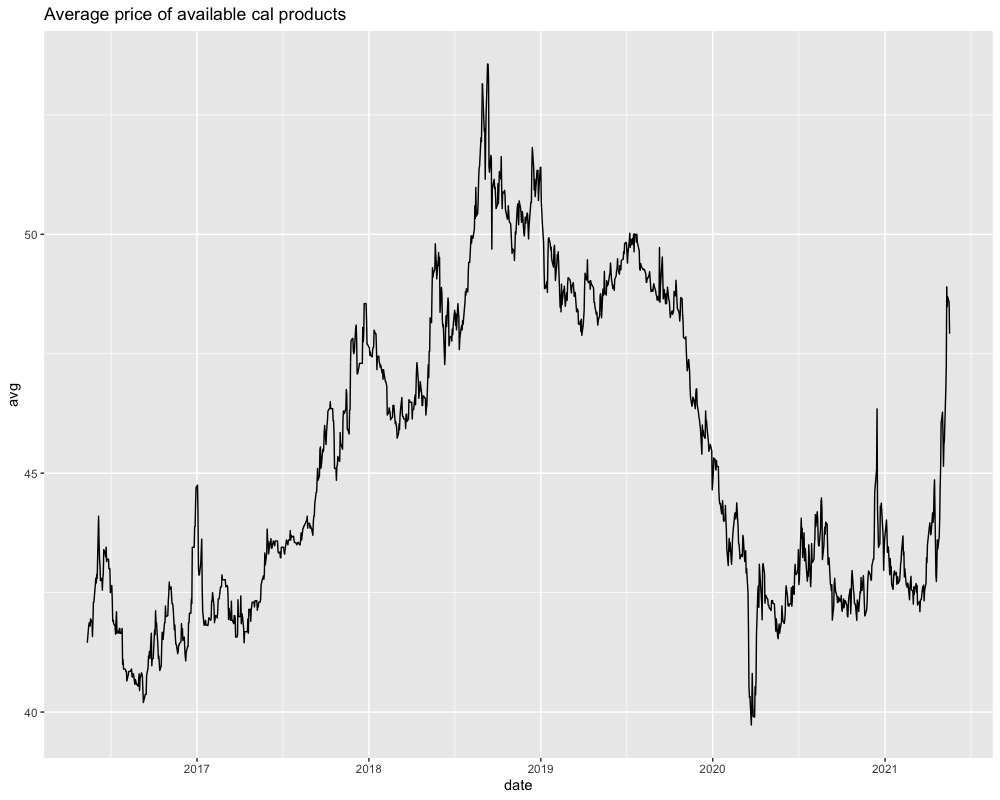

On the graph below, we see a historical evolution of annual futures prices in Spain – an intra-year seasonality should reveal itself in certain repeated price patter over the years – as can be seen, that is not the case. Prices seem to evolve over time without any particular trend or pattern, purely dependent on the current market expectations.

To make it easier and more intuitive to compare, let’s create just one time-series – a simple average of all available Spanish annual products at any given point of time. This would result in a series presented below:

Now, the lack of intra-year seasonality is more transparent.

But how does that relate to the PPA price behaviour?

Since the market prices are the main driver behind the bids, it should be expected that PPA price behaviour would closely follow the path of “the market”.

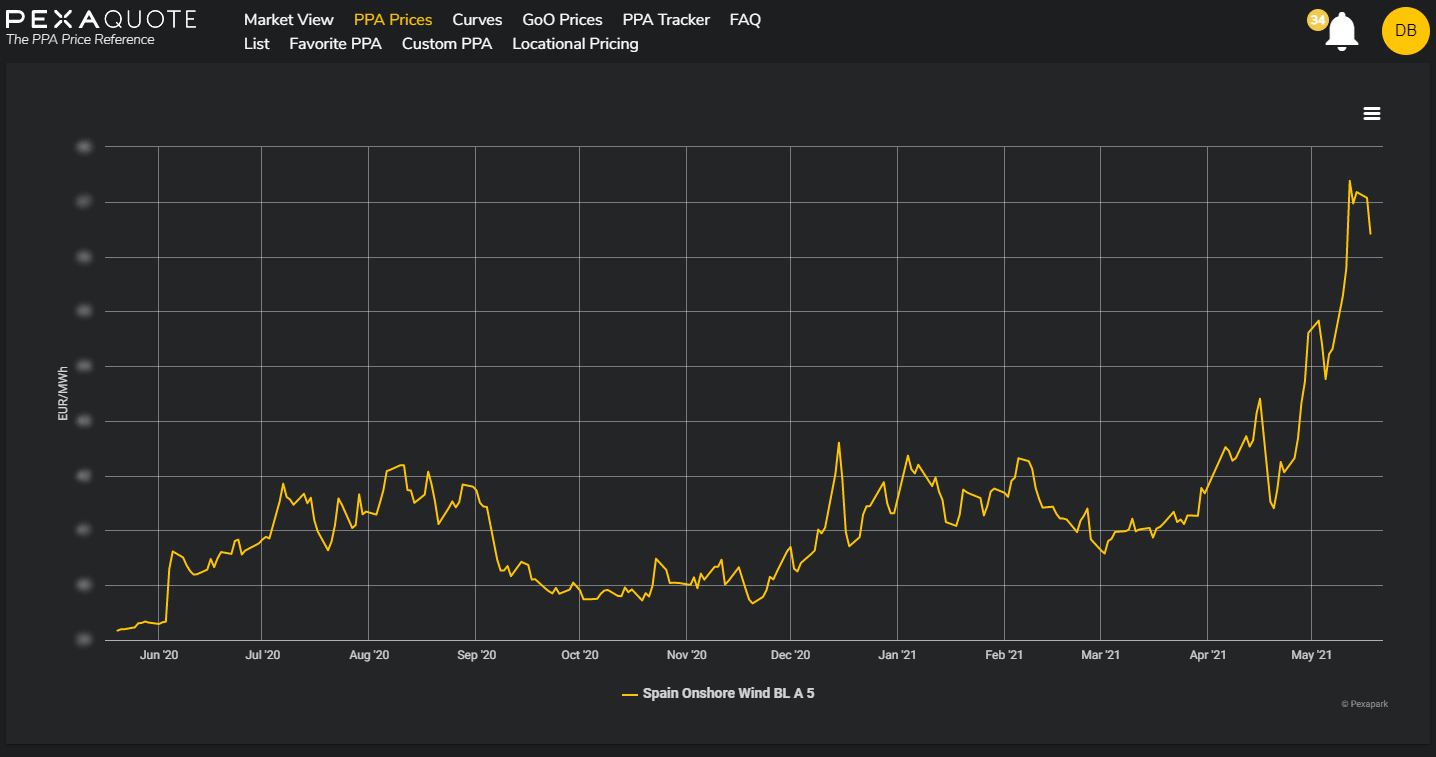

Let’s take a history of Pexapark’s price reference data from PexaQuote, of Spanish BLA PPA for Solar for 5 years and plot it against the market:

PPA price fluctuations are clearly driven by the market and therefore the lack of seasonality is evident in both of them.

It can now be assured that purely from a pricing perspective, there is no better or worse moment within a year to close a PPA. It all depends on the current market conditions, which are not seasonal – if they were, there would exist some arbitrage opportunities and we would expect market to quickly correct itself.

Does that mean that there is no point in tracking PPA prices?

Of course, not – it’s always valuable to understand if the current price is on the ‘high or low end’ and to learn more about the market conditions behind the price evolution. Seeing historic pricing data gives us a view of price changes and the price impact of various events – events which are very difficult to foresee into the future. For example we can see the price drop in below chart as an impact of COVID and fears of reduced future demand. We can also see an increasing trend due to increasing fuel price etc.

Whilst it is not possible to predict future pricing, you can sense check your pricing against what has actually been achieved in the market, ensuring your asset valuations are realistic and investment goals will be achievable. Understanding how events have impacted pricing historically will also help you to refine your pricing strategies, so you can cost in potential risk to your PPA prices. Finally being able to evidence clear and trusted data showing the minimum and maximum prices for the last 12 months gives credibility to your negotiations. This will help you to reach a satisfactory conclusion faster whilst maintaining good relationships with your counterparties.

If you want to effortlessly see PPA pricing intelligence to support your investment goals and negotiations – there is no better way than to sign up to our renewable price reference platform, PexaQuote.