Risk Self-Assessment Tool

Get a full report in your mailbox within 72 hours

Access the self-assessment tool

Until recently, most renewable assets have been state-subsidised under different support schemes such as Feed-in-Tariff (FiT), Feed-In-Premium (FiP), and others.

The support schemes shielded asset owners such as independent producers and investment funds from fluctuating prices seen in wholesale traded power markets.

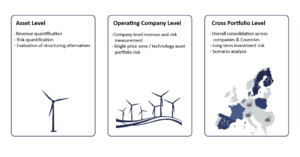

The phasing out of such support schemes creates a new challenge for newly built assets as well as for assets gradually fading out of the different support schemes – both on the asset and portfolio levels, as illustrated in the diagram below.

Utilities and commodity trading houses have long developed tools and skills to manage market risk, indirectly offering risk management services to project owners via power purchase agreements (PPAs).

These contracts provide the long-term price stability required to obtain project financing. While they are widely adopted in countries with no FiT schemes, the risk management techniques underlying the PPA structuring are rarely understood outside utilities and trading houses.

As the market evolves, we believe that the knowledge and practices of managing risks should be widely addressed in the renewable player organisation of the future.

The DEEP Risk self-assessment tool and the logic behind it

Renewable assets carry different risk profile than other assets. On top of the traditional price risk, there is balancing risk covering the gap between production and baseload committed, as well as weather seasonality which triggers stochastic production.

All this combined with different technologies, cannibalisation and the lack of correlation between those parameters makes it very challenging for renewable players to predict revenue and/or manage risk.

At Pexapark we created the DEEP method to help our customers understand their specific position with respect to risk management taking into account Diversification, Exposure, Experience, and Processes required to manage risk on an on-going basis.

With over 35% of our clients reporting an on-going risk management and hedging practices, we believe that such a bird’s eye view approach can provide guidance and help our customers prepare for a future of uncertainty.

You can access the self-assessment tool by submitting the form.

Once you’ve answered the questions, you’ll get a full report in your mailbox within 72 hours.