The PPA market in Europe continues to grow and mature. But new challenges arise with growth and maturation. One of those challenges is the sheer number and diversity in types of PPA contracts.

The Need for a Standard PPA Contract

This abundance of PPA contract types can create uncertainty and confusion for players in the market. Which PPA contract template is best for the needs of different parties? How can one do a comparative analysis between PPAs with so many different types available? This uncertainty is a reason why PPAs remain a complex process.

A standardisation of PPA contracts could certainly be helpful. On that premise, we have examined the new PPA template issued by the European Federation of Energy Traders (EFET).

After reading this article, you will understand how the new EFET template is structured and what are its benefits. By means of a simple case study, you will gain insight into the gist of the template and how it could be used for your PPA project.

Some Current PPA Basics

- PPAs continue to increase across Europe

- There are high costs associated with closing a PPA due to their complexity

- Utilities continue to rule the market

- The majority of PPAs are on the basis of ‘long-forms’

The latter point is especially important. ‘Long forms’ are essentially agreement templates developed in-house by utility off-takers. This makes sense given that some utilities have been doing PPAs for many years. Therefore, they have their own know-how and established criteria to undertake PPAs. They also have their own in-house legal teams.

Due to their long-standing predominance in the PPA field and access to in-house legal departments, utilities currently adopt a ‘fit-for-purpose’ approach to PPAs.

There remains, however, a general consensus in the market for a standardised PPA structure/template. As we know, markets crave certainty.

What is EFET?

The Amsterdam-based EFET was founded in 1999 in response to the liberalisation of electricity and gas markets within the EU. EFET is already well-established in standard power products, such as its well-known Individual Power Purchase Agreement.

The new template released in 2019 by EFET reflects the needs and concerns of renewable producers and corporate off-takers engaging in long-term transactions.

The new template was developed in collaboration with the wind and solar power associations, RE-Source, and other stakeholders with whom relationships were fostered over the last three years.

The aim of EFET is to provide standard solutions for common aspects of wholesale transactions in the European energy market, such as contracting and data exchange. The new template for PPA transactions is a logical extension and maturation of that role.

Three Elements of a Good PPA

Before we continue further, it’s important to understand the rationale for a new, standardised approach to PPAs. One goal is to improve PPAs generally. But what constitutes a ‘good PPA’? Pexapark believes these are three most important elements in a good, commercially viable PPA:

- A clear commercial structure and allied risk allocation

- A clear credit and early termination concept, i.e. how early termination is dealt with

- A sound legal framework in terms of change of circumstances, law, taxation issues and dispute resolution

Energy Risk Allocation is Everything

This article will focus primarily on the first factor listed above, i.e. that relating to the commercial structure and how risk is allocated. Pexapark believes that the issue of risk allocation/distribution is the leading cause of problems within PPAs.

Risk allocation is crucial because it is so multifaceted within a PPA, as can be seen in the figure below:

In this context, it is important to re-stress how many different types of PPAs actually exist. These include Cap and Uncapped Pay-As -Produced, Baseload, Fixed Solar Shape, Hourly Profile, Monthly Baseload and Fixed Volume PPAs, among others.

Pexapark sees these differently-ascribed PPAs as “name tags” – at their core they represent different risk profiles and risk allocations for parties thereto.

A Singular PPA Price Formula

Financial PPAs can be essentially captured in one price formula, which is defined by how the volume is set (in terms of volume production) and how the floating price is set against the agreed-upon fixed price. One can view all risk allocation in a single formula. This formula is niftily explained in the figure below:

There are many structuring options available to parties to a PPA. As per the formula above, the three key factors are those of 1. volume, 2. the floating price and 3. the fixed price to which parties agreed. Risk is allocated accordingly to each of these key factors. An overview of examples of these different PPA structures can be seen in the table below:

The easiest factor to ascertain is that of the fixed price, of course. So, as an example, and taking the above into consideration, a producer in a baseload PPA might have a financial obligation to deliver each hour with the same production swapped against the average spot price realised at a given time.

Change the type of PPA and swap factors around for a different party thereto and you have a completely different risk profile. Ditto for a pay-as-produced structure or any other PPA structure for that matter.

The beauty of this template/process is that any party to a PPA can better comparatively quantify their risk undertaking vis-a-vis other parties to the PPA.

Worth noting is that a key class relating to volume as a factor is that of assurance regarding production performance and availability. If a PPA has high availability or performance guarantees, this can re-introduce or heighten volume risks for a producer.

The beauty of the new EFET template is that it incorporates all three of the key factors in determining the risk profile of a party to a PPA, namely the volume, the fixed price and the floating price.

Basis of PPA Contract Settlement: Financial or Physical

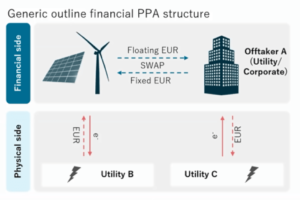

There are also different types of settlements such as a financial and a physical, as can be seen here:

However, the hypothetical case study discussed hereafter is purely a financial contract. As such, there would be no obligations on balancing. Nevertheless, in financial PPAs with corporate offtakers, buyers often want to ensure that physical production is delivered to certain balancing pools and/or a route-to-market agent is contracted.

It’s worth noting that the same could occur in a physical settlement, in which different parties are structured in a similar way. For example, you could have direct delivery between a producer and seller and still have separate utilities providing balancing services.

Of course, many different combinations of the above are possible, which is why clarity on all factors, whether on the financial side or physical side, is so important from the outset. This is especially true for the delivery point and who will provide which service as per the terms of a given PPA.

PPA professionals know that any PPA can have dozens of unique terms and conditions attached thereto. Yet another reason why a rationalised, standardised approach such as that available with the new EFET template is so needed for the PPA market in Europe.

The Structure of the New EFET PPA Sample Contract

In our opinion, the template is very well-drafted. It is flexible, making it a document that can be adjusted according to the specific needs and context of a given agreement. Furthermore, Luca believes it holds the potential to streamline PPAs. This should make PPAs less complicated and also reduce transaction costs.

The new template is set up in three sections:

Part I – Individual Terms. Section A deals with commercial parameters. These include the basis for settlement, supply period, volume definition, pricing, certificate and balancing.

Section B of Part II deals with more general provisions, such as condition precedents, construction and commissioning and termination amount. This is seen as the most significant section in this new EFET template with regard to potential long-term benefits for less complicated, less expensive and more standardised PPAs.

That is because with a predetermined termination amount, parties would need only choose a certain option, since they already have clarity on how it works. This occurs if the termination amount is read in conjunction with Part II of the template, provisions of which might deal with factors such as changes in law, dispute settlement, remedies for non-delivery, force majeure, and so forth.

Even with a simple term sheet, having clarity regarding the credit risk side and changes in legal factors creates the basis for a solid PPA.

Case Study: A Focus on Commercial Factors

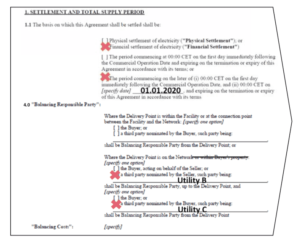

We can illustrate the flexibility and comprehensiveness of the new EFET template by means of a hypothetical case study based on Part I Section 1 of the EFET template, namely commercial factors.

For this purpose, let’s assume that it’s a financial agreement for a supply period of 10 years, with volume defined at 75% of capacity with no cap. The agreed price formula is hourly pay-as-produced at 40 EUR/MWh. The settlement is monthly with balancing excluded.

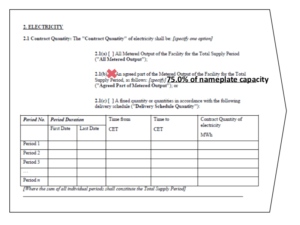

A snapshot of input into the new EFET template can be seen below:Using the case study example, one can see how section 2.1 of the new EFET template could be inputted regarding the contracted volume/energy output amounts:

Section 2.1

It’s important to re-stress the relevance of availability and performance guarantees regarding volume. Also important is that if a party has negative price clauses in the contract, this might affect the volume off-take.

Section 2.2 of the new template continues with pricing with a Profile/Cannibalisation focus, in which the fixed price element is added to the swap formula. The floating price element is added thereafter.

Important in section 2.2 of the new template is the correct prescribed definition. An incorrect definition can result in a completely different PPA, so attention must be paid.

In the EFET template, the defined calculation agent (typically the off-taker) will calculate the price differential between sections 2.2d and 2.2e (see figure below) and apply it under Contract Quantity (defined under section 14.3, Part II of the EFET template).

An example of this Profile/Cannibalisation section can be seen above. Included in this instance are the fixed price (40 EUR/MW h) and calculation period (monthly).

The price differential is calculated between the fixed price at 2.2d and the realised average market price (the floating price) defined under section 2.2.

This case study was only a ‘slice’ of the new EFET template for PPAs. What can be highlighted is the ease of use of this new template, particularly regarding the pricing formulas, which Pexapark believes should cover up to 99% of all PPA structures.

Will the EFET PPA Contract Template Be Adopted?

Notwithstanding clear benefits, can this new EFET template become the basis for PPA negotiations? Is its adoption a given? Pexapark is unsure since much depends on the producers. However, as utilities are increasingly willing to use the EFET template, we believe that the new template would ensure quicker, more streamlined future PPA contracts.

There are other issues in the PPA market that may also have a bearing on the adoption of the new EFET template. One of those issues could be that of negative prices. Luca explains how this is a new issue popping up all over Europe by which spot prices were in the negative range for one or more hours at a time.

Pexapark believes how this is dealt with between producers and clients/off-takers would be a matter of commercial negotiation. Discrepancies will likely be rectified by the market.

For example, there is no rational incentive for a producer to include a negative price clause in a baseload contract as it would obviously limit the volume uptake. On the other hand, certain rationale to have such a clause could exist in a pay-as-produced contract, i.e. that the risk would be shared between the producer and off-taker.

On the viability of this new template, it’s important to note that a number of large PPA contracts have been negotiated using the EFET standard – upon which the new template is based. Utilities are well aware of the new template via their trade associations. These facts should bode well for future adoption of the EFET template for PPA contracts.

Ultimately, the pricing formula contained in the new template is a key factor in ensuring that all commercial aspects are covered in any proposed PPA. It allows for a comprehensive pricing of risk, which – together with risk allocation – is at the heart of any viable, sustainable PPA contract.

Get access to Pexapark’s renewable pricing indices. Try for free here